wv state inheritance tax

What You Need to Know About Capital Gains Taxes. Annual tax on incomes of certain carriers.

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

West virginia tax procedure and administration act.

. Does Your State Collect an Inheritance Tax. A federal tax lien exists after. There is an estate tax based on a decedents total gross estate and limited to the credit for state death taxes allowed on the Federal 706 estate tax return.

18 As of 2019 migration of 14209 into the state. Reset Search Reset Sorting. Recently Legislated Tax Changes.

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Acquisition of lands by United States. Puts your balance due on the books assesses your.

Houston - 3075388. For bail reform in New York it is the responsibility of a friend or family member to contact a reliable bail bonds company once the judge has set bail. Gig Economy Work and Your Virginia Taxes Even if its part-time temporary or side work the income you earn through an app or website for services like making deliveries selling goods online or driving for hire is typically taxableRead More.

West Virginia does not impose an inheritance tax. The process for probate requires following certain steps all according to West Virginia state law. WEST VIRGINIA Sales Taxes.

REV-419 Employees Nonwithholding Application Certificate Virginia Tax. Because of the phase-out of the federal estate tax credit West Virginias estate tax is not imposed on estates of persons who died on or after January 1 2005. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not exceed the 25-percent bracket threshold amount 2 25 PERCENT BRACKET25 percent of so much of the taxable income as exceeds the 25-percent bracket threshold amount but does not.

As such you arent required to pay tax on the entirety of your deceased partners 401k. Execution of process and other jurisdiction as to land acquired by United States. Phoenix - 2972357.

North Dakota has no state inheritance or estate tax. Tax Expenditure Limits Latest News. Preferred Tax Treatment An immediate annuity may be a good strategy to defer taxes until later in your retirement when you may be taxed at a lower rate.

The underlying premise of Anglo Saxon Law on property can be put in a simple phrase. Can my state tax refund be direct deposited. West virginia office of tax appeals.

How do I file state taxes. Interstate arbitration of inheritance and death taxes. You should only pay tax on the part that you.

State Minimum Wage Average Workers Compensation Costs Right-to-Work State. WV 46 VA 30 MD 37 DE 18 AZ 1 NM 42 KS 34 AR 20 TN 10 NC 12 SC 7 OK 29 LA 50 MS 40 AL 21 GA 9 AK 49. BirthCertificateState is a privately owned company that offers expert assistance to help you obtain original certified copies of state vital records which.

Name Filter Name Filter. Los Angeles - 3792621. The remainder is your state tax refund status.

West Virginia is the least populous southeastern state. Overall the probate process is managed by the personal representative of the estate. Minimum severance tax.

2019 Virginia Resident Form 760 Individual Income Tax Return Keywords. Tax penalty and additions to tax amnesty. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law.

Employees Statement of Residency in a Reciprocity State Pennsylvania Department of Revenue. Reciprocity West Virginia State Tax Department. 6 prescription drugs and groceries are exempt.

2019 Virginia Resident Form 760 Individual Income Tax Return Author. The lien protects the governments interest in all your property including real estate personal property and financial assets. County and local taxes may increase.

New York - 8175133. The tax rules stipulate that you are only required to pay taxes on the payments you have actually received. Virginia Resident Individual Income Tax Return Created Date.

The basics of the bail bonds process in New York is similar to every other state aside from a few differences that make a difference for those working with a bail bond company in the state. Virginia officially the Commonwealth of Virginia is a state in the Mid-Atlantic and Southeastern regions of the United States between the Atlantic Coast and the Appalachian MountainsThe geography and climate of the Commonwealth are shaped by the Blue Ridge Mountains and the Chesapeake Bay which provide habitat for much of its flora and faunaThe capital of the. You can either fill out your state tax form by hand and mail it in or file electronically with an e-filing program or online tax preparation software.

Reset Search Reset Sorting. This differs from other types of annuities for which the tax burden is front loaded Safety of Principal Funds are guaranteed by assets of insurer and not subject to the fluctuations of financial markets. Why Utah Leaders Call this Economic Ranking.

This individual may be named in the will or if no one is specified in the will or there is no will then he or she is selected after the deceased persons death. Use it or Lose It The idea of property lying fallow and unused or owned by distant Lords was disliked by the tax hungry central Kings and they constantly worked at passing statutes that would force the various landholders to either make the land profitable or lose it. 20 Largest US Cities.

Name Filter Name Filter. North Dakota Office of State Tax Commissioner. Counties comprising state of West Virginia.

Form 760 - 2019 Virginia Resident Individual Income Tax Return Subject. Estate Inheritance Tax Levied. You can also hire a tax professional to help you file your state tax return.

Form NDW-R Ohio Department of Taxation.

West Virginia Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

State Estate And Inheritance Taxes Itep

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Rates Forms For 2022 State By State Table

How Do State And Local Severance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Estate Tax Everything You Need To Know Smartasset

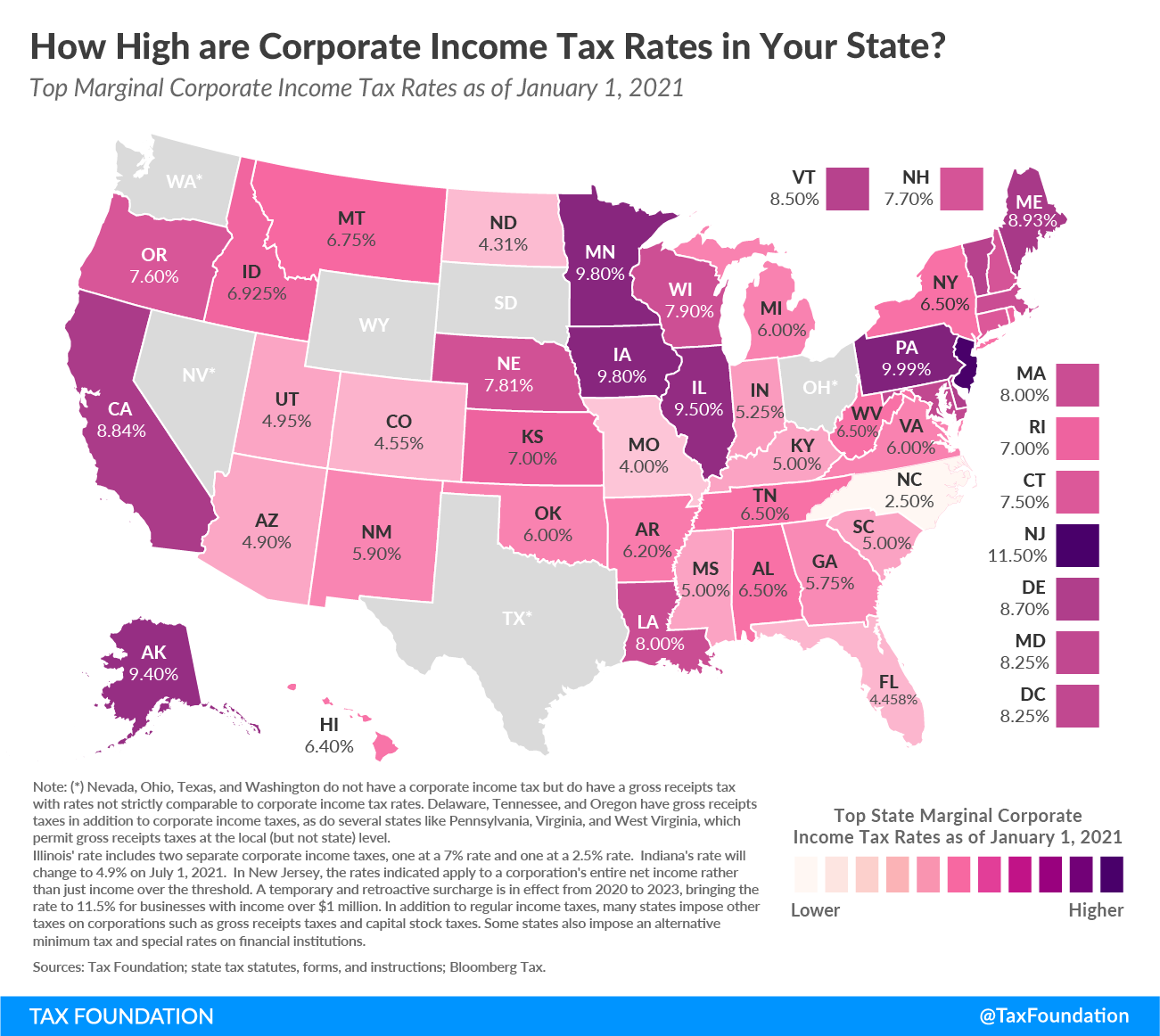

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

West Virginia Estate Tax Everything You Need To Know Smartasset

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Altered State A Checklist For Change In New York State Empire Center For Public Policy